Software-as-a-Service (SaaS) Business Model

Software-as-a-Service (SaaS) is based on the linear digital business model and uses the internet as its value delivery channel with the code hosted on the cloud. There are SaaS solutions for pretty much all consumer software as well as a lot of enterprise management software, including most of the traditional software that have moved to the cloud.

Part 1: What is SaaS?

Do you remember the time we had software? Well, we used to have it but it is increasingly disappearing. What used to be software is increasingly moving to the cloud. With that it transforms to software-as-a-service or simply SaaS. For startups in the software space, SaaS will be the most likely option.

What is SaaS?

SaaS is a cloud-based way of delivering software to clients where the smarts and the data are hosted centrally on the SaaS firm’s servers on the cloud. Within this, the SaaS firm could own their servers while many are hosted on a cloud solution themselves such as Amazon Web Services or Googe Cloud.

The users typically access SaaS solutions via web browsers or dedicated Apps

SaaS is basically everywhere where we previously had (desktop) software.

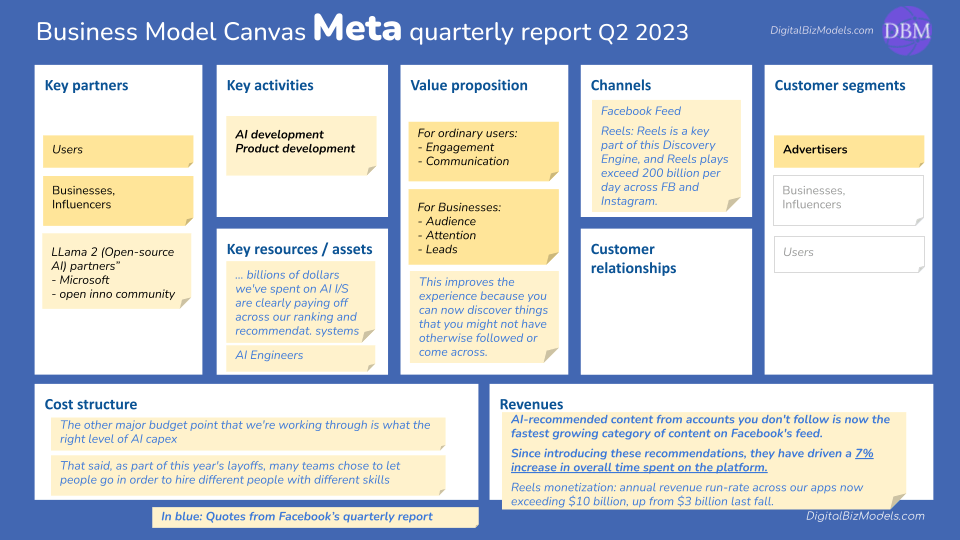

Linear value creation flow

A great share of the biggest digital technology businesses are based on the platform business model. But SaaS is entirely based on the linear business models. That said, there are some SaaS solutions that add platform business model elements to their solution but at the core are still a linear business model.

Check out our Complete Guide to the Platform Business Model to learn more about the differences between these two types of biz models.

Categorising SaaS

Looking at Crunchbase we will find over 25,000 SaaS companies. And of course, we can be sure that this is just the fraction that have already somewhat scaled. Some areas seem to be particularly well presented. Or shall we say over-presented? There are over 8,000 marketing solutions.

Let's take a look at some of the major categories.

Productivity SaaS

One can categorise SaaS in many different ways. The mindmap does so by major value proposition.

On the left we see the very popular and fast growing type of SaaS productivity tools. In the past dominated by Microsoft's desktop (and non-SaaS solutions), there are now many exciting tools covering all sorts of value propositions.

Microsoft is following the trend and has moved many of their Office tools to the cloud with which they are now SaaS.

But there are many other very exciting productivity solutions such as: Slack, Trello, ClickUp, Miro and Monday to name some of the better known ones. If you have used any one of these you know how engaging they are to use. Then there is of course the suite of tools by Google as well as Adobe which are all centred around productivity & creativity.

Our Flagship Course

Enterprise resource planning (ERP) / enterprise software

On the right hand side of the mind map we show the huge field of enterprise management software traditionally known as enterprise resource planning software or ERP. It’s now often just called enterprise software. Best known are SAP and Oracle.

But there are thousands of other companies in this space. There are:

6,200 companies under “enterprise resource planning” on Crunchbase and

20,000+ under “enterprise software”.

Some have started by focusing on one area within the traditionally huge field of ERP.

Let’s take the space of human resources (HR) As an example withing ERP:

It now has grown so large that there are many subcategories with innumerable amounts of SaaS solutions.

In fact, even the overall category runs under a few names, such as HR, human resources management (HRM) or human resources system (HRS) among others.

Some focus on just one function, say payroll, within the field of HR.

Others combine several functions and modules (take Workday).

Some focus on small and mid-size companies and may endeavour to expand to larger businesses from there.

Typical modules of HR systems are:

Recruitment

Training

Payroll

Leave management

Expense management

Performance management

Career management

Talent management

And more

Free Downloads

Best-of-Breed SaaS

Traditional ERP often aims to cover all aspects. Newer SaaS solutions often starts with a focus on one or more modules and expands from there. The focus on individual modules within traditional ERP is sometimes also called best-of-breed enterprise software because they aim to excel the respective modules of traditional ERP software.

It’s not different in the other core ERP functions with finance most likely being the biggest one. It’s a huge field of probably thousands of solutions. There are multiple sub-categories in their own right with hundreds of SaaS solutions and fuzzy boundaries and overlaps with other categories.

Specialised SaaS solutions

Aside from these two major categories there are many other categories which we have combined under “specialised” SaaS solutions.

Three example subcategories are CRM/marketing, ecommerce solutions and web asset management. There are thousands of SaaS solutions just in the CRM/marketing space (8,000 and counting just in marketing). It is also how Salesforce once started who were one of the early protagonists of SaaS (or let’s say the move of software distribution to online channels).

The other sample category for specialised SaaS are ecommerce solutions. eCommerce solutions such as Bigcommerce are SaaS solutions that companies can use to create their own web stores with the many aspects and customisability options that are part of it.

Another super-exciting space are web asset creation SaaS of all sorts and flavours. Well-known examples are Wix and Squarespace to build websites. But both are expanding to other areas. Wix has expanded into eCommerce websites including web store functionality. With this they are now directly competing with the likes of Shopify.

Collision course?

This is a common trajectory whereby initially different SaaS may end up becoming direct competitors over time on a set of core features and thus customer segments. SaaS solutions may initially provide distinctly different value propositions but over time their value propositions can overlap such that over time they become competitors (at least to some degree).

This may intensify or reduce depending on the chosen trajectories. It is likely to lead to a consolidation in the SaaS space.

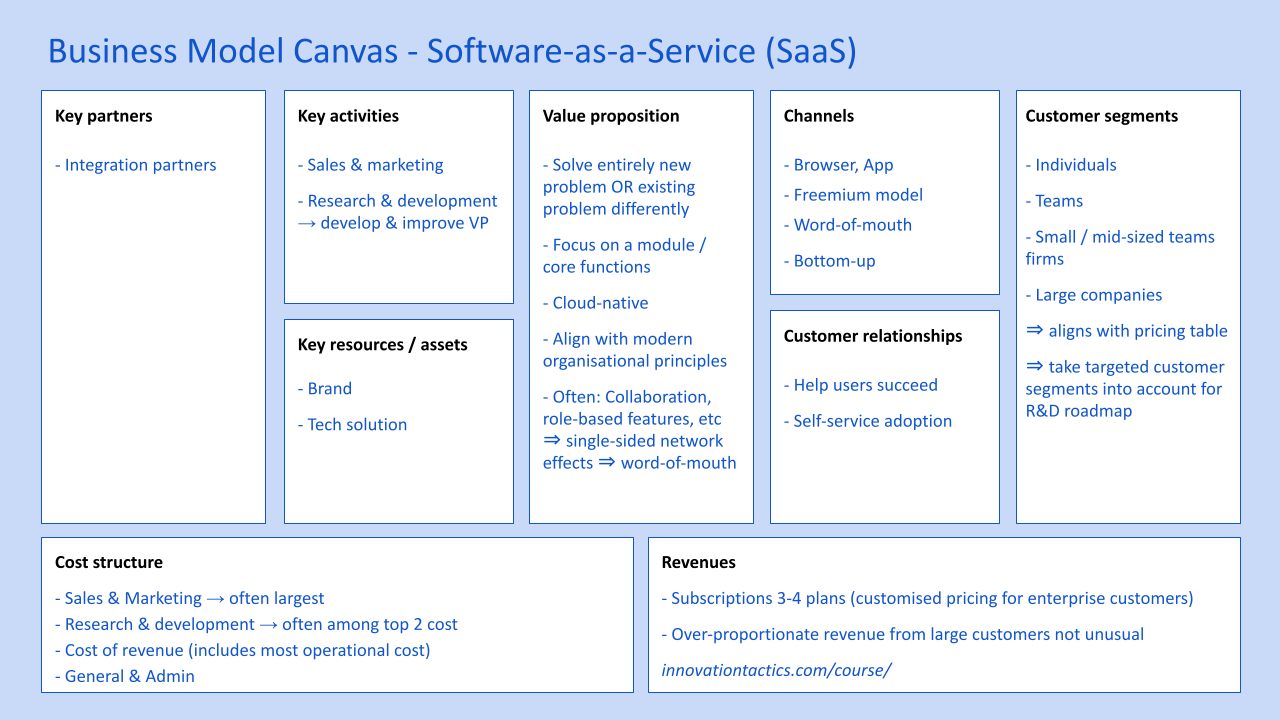

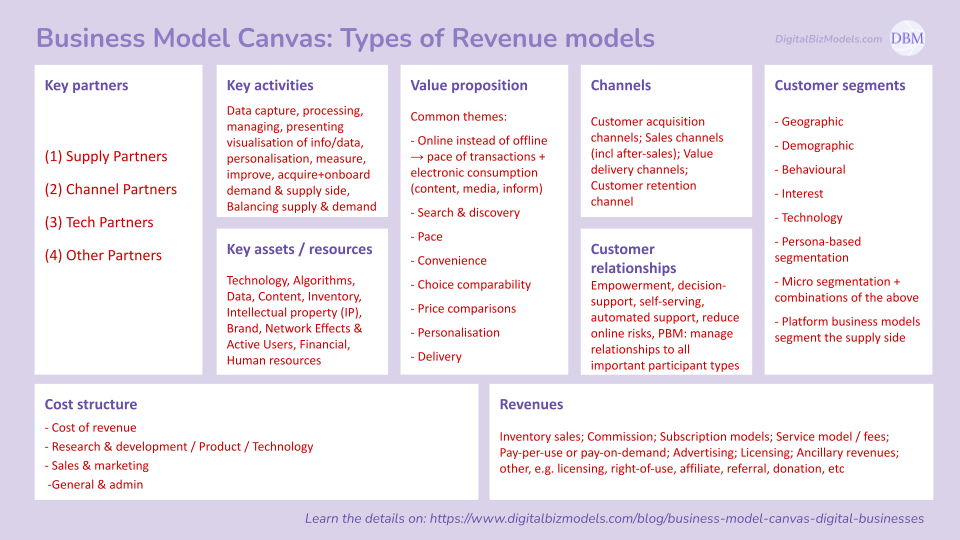

Part 2: SaaS Business Model Canvas

Business model canvas

Software-as-a-Service Business Model Canvas

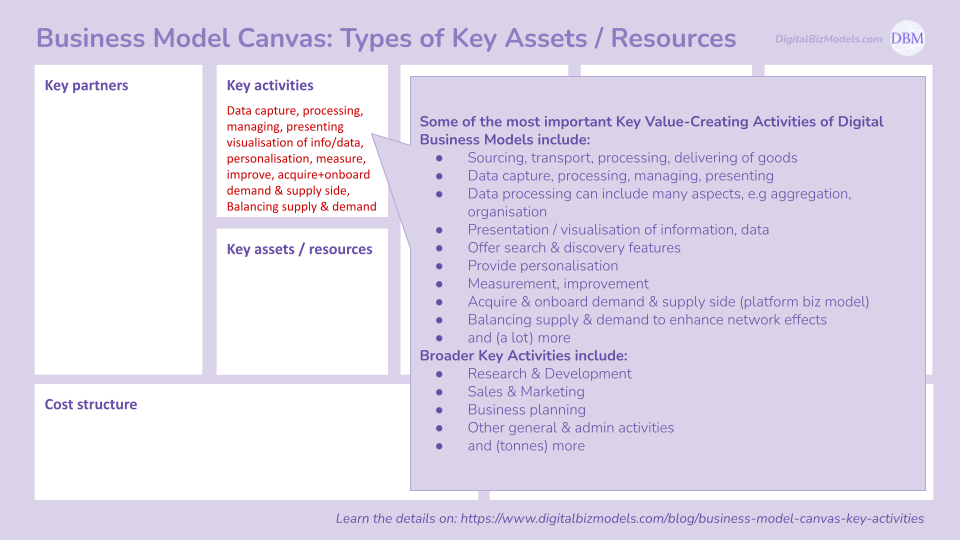

Key Activities

Let's start with the key activities of SaaS firms which we will use to organise the rest of the business model canvas around.

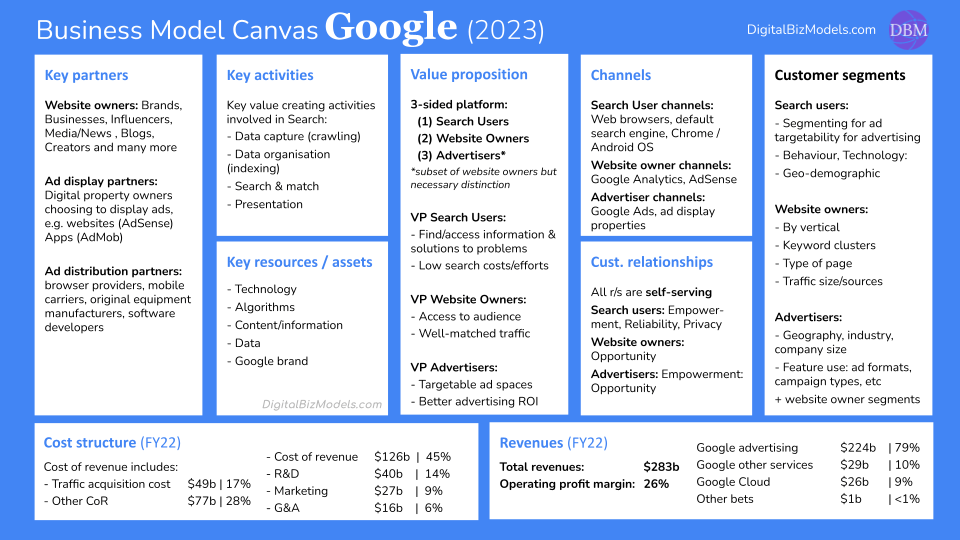

A comparison of the cost structures of many SaaS firms will show a repeating pattern: the key cost elements are:

Research & Development (R&D)

Sales & Marketing (S&M)

This is why these are the key activities (on a high level) that play into all the aspects of the business model. We will get some more details into both aspects as we walk through the rest of the biz model canvas.

Within early SaaS companies both of these items can exceed 100% of the firm's revenues. But even in the scaled state both activities will typically be the highest cost elements. R&D cost as a percentage of revenue can exceed that of platform business models. This has often to do with the subscription revenue model which is invested into ongoing development of new features and improvement of existing features.

Here we show 3 SaaS companies and their costs (as a percentage of revenue) for these two key activities. Note that Slack has been acquired by Salesforce, hence we're showing the numbers from the last annual report prior to that event.

Salesforce and Adobe are two of the purest SaaS companies in that a majority of their revenues are generated by the SaaS business model.

A key activity within their R&D activities is to develop (and improve on an ongoing basis) their value proposition(s). This includes furthering the initial value proposition as well as developing new ones.

An important question for SaaS startups is how to get started?

One way of getting started is to solve an entirely new problem. But that’s probably less often.

Hence, many SaaS solutions emerged simply by solving an existing problem differently.

This is very high level and we will add to this more thoughts throughout this article.

Salesforce, Workday, Concur, Zendesk are SaaS providers who started by focussing on elements that are also part of traditional, large enterprise resource planning or ERP systems as offered by SAP and Oracle.

These early companies were sometimes SaaS category creators because they were the first ones to move the respective features & functions to a standalone SaaS solution.

Focussing on a core element of a traditional solution and making it cloud-native is an important way of getting started.

Learn more about key activities in digital business models here.

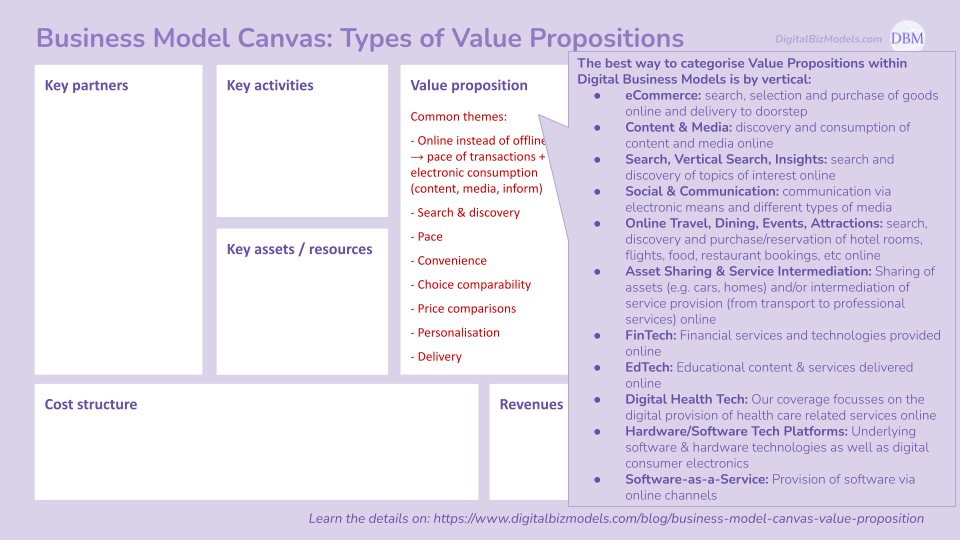

Value Proposition

Cloud-native solutions often differ from cloud-migrated solutions (i.e. legacy software moved to the cloud) in ways that users can tell immediately in terms of look & feel, etc.

But often there are more fundamental differences.

Some of the most successful modern SaaS solutions follow a number of principles that underpin their success. Let’s just take three sample principles:

They align with modern organisational principles

They reduce admin work by moving data entry to the source

They provide features useful for all that are affected by the software (as opposed to a management / admin level)

Let’s compare two project management solutions: MS-Project vs ClickUp to demonstrate these points.

MS-Project vs ClickUp

MS-Project was introduced in 1984 but has recently been moved to the cloud. Undoubtedly, it is now more collaborative than it was as a desktop software.

Nevertheless, it still caters more towards the old model of one project manager managing the entire project for the whole team (or most of it). The skill set required as well as the pricing model make this very clear

The very technical view of a GANTT chart may already put a mental barrier for many users irrespective of how difficult or easy it may be. I used it for years - it's not a bad tool lbut just not everybody's cup of tea...

ClickUp is very different in its entire philosophy. There are many different views including very simple things like to-do lists, a great focus on collaborative and communication features, etc. Things that anyone can use without knowing anything about project management.

The simplicity of the UI and the intuitiveness of the UX make this pretty clear.

It helps with the adoption of the software through individuals.

A focus on collaborative features sets single-sided network effects in motion that help to spread the word within the firm and find the exact right people that the tool will provide value to (a marketer’s dreams).

These are very important links between the R&D and sales & marketing activities within the business model. I think it's fair to predict that if a SaaS company would come up with a SaaS tool like MS-Project, they would simply not succeed.

For modern SaaS tools to succeed their solution needs to have certain characteristics pertaining to its design philosophy, UI & UX. Some of these are that the solution is:

Self-explanatory

Engaging to use

Have various types of support functions and

Provide immediate use

You can add more to this list depending on what field your idea is in. But if you tick these boxes, individuals and teams can get immediate use without significant investment which removes barriers to self-adoption.

As we have said in the previous videos, we also want to leverage network effects with our SaaS solutions. This will help to stimulate internal word-of-mouth.

Key takeway: SaaS solutions are developed with word-of-mouth as an important acquisition channel in mind.

Learn more about the value propositions of digital business models here.

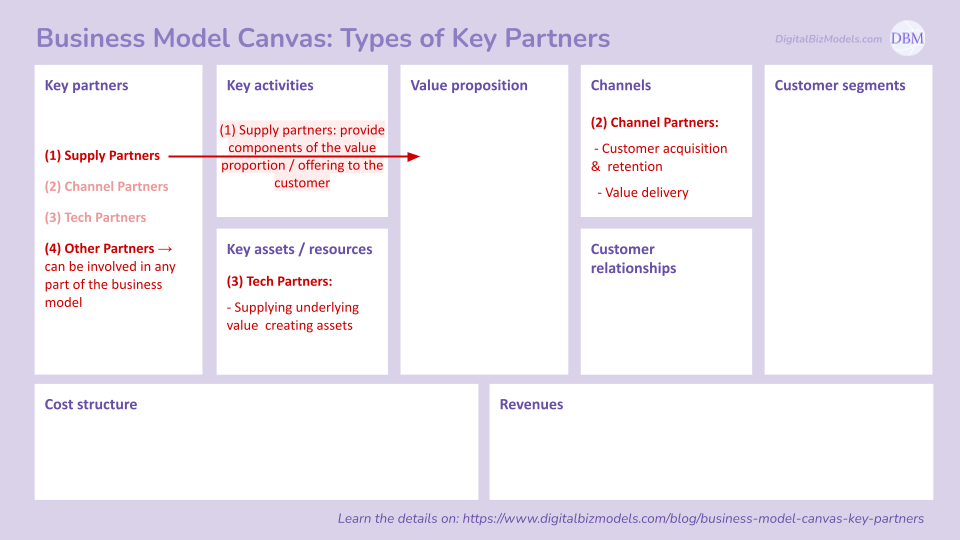

Key Partners

For SaaS the most important key partners are integrtion partners. All other partners from cloud shosting to specific libraries are secondary key patners.

Learn more about key partners in digital business models here.

Integrations for Productivity Software Slack

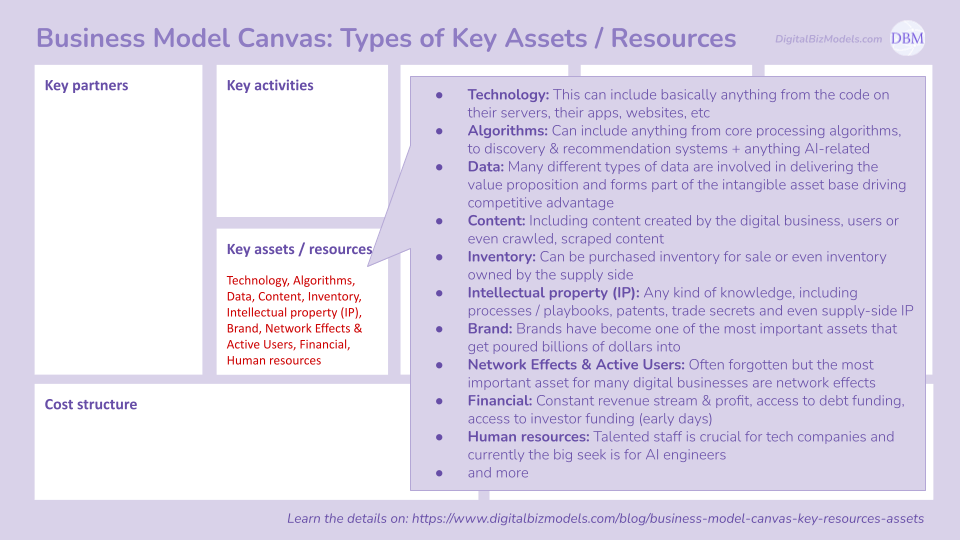

Key Assets / Resources

This also brings us to the SaaS firm's key assets & resources which to a great deal are based on the technology solution that is delivering their value proposition as well as the intellectual property behind it.

Many SaaS solutions have their origin in a key idea or feature that they initially became known for. Wix was this unbelievably easy way of building great websites without knowing any html; Slack invented channel-based collaborative tools as part of improving their ways of working (initially their aim was to develop an online game); Trello was this very easy and distributed way of organising team work and projects.

The other noteworthy key asset is the brand. All SaaS will aim to build a brand through various marketing methods that will stand for what their solution is known for (formed by their initial idea).

With that two of their key assets are their:

Technology solution

Brand

Learn more about key assets & resources in digital business models here.

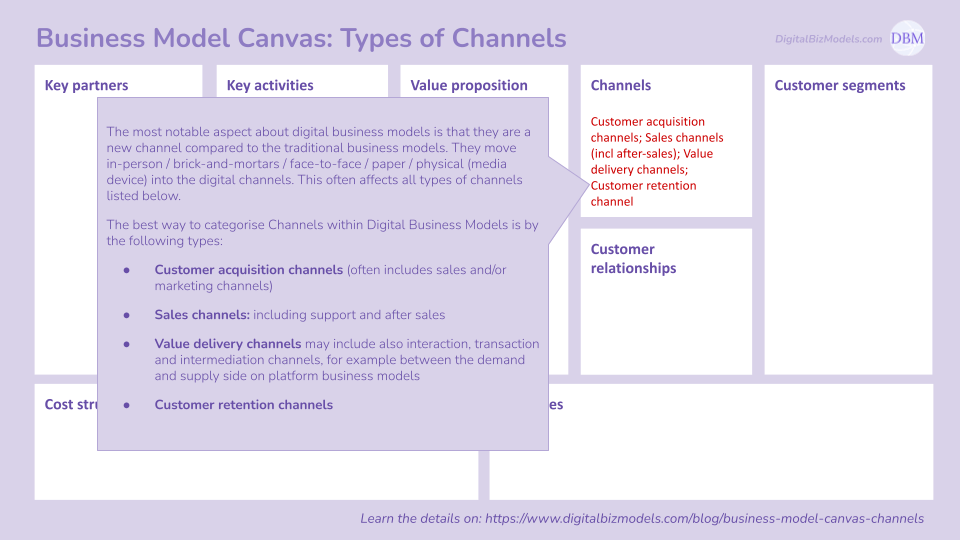

Channels

Access through common web browsers & free Apps

One of the most essential differences of SaaS and traditional software are the value delivery channels. SaaS uses web browsers, apps and other channels for the delivery of value. The software is no longer installed on local machines.

Access through common web browsers (and a free App) is also important from the perspective of customer acquisition.

But another aspect is very important in this context: The ability to access at least a basic layer of software functionality freely. This bring us to the Freemium pricing model.

What is Freemium?

Freemium (a combination of Free + Premium) refers to a pricing model that consists of free access to a basic (but useful) layer of software functions and a priced (premium) layer of functions. Broadly speaking, the free layer comes with limitations. These limitations can pertain to a range of product characteristics: the feature set, limited capacity (e.g. only 3 documents savable), limited users, limited support, etc.

But Freemium gets confused with a number of other things that it's not, notably: Free Trials and Free-forever (more in a second).

Relevance of Freemium: reduction of barriers to use

While technically-speaking the freemium model is not a "channel" as such, it is very important in the acquisition of customers and complements the access via web browser and the (free) App.

The combination of these two elements are important for the same reason: to reduce frictions / barriers to the usage of the software.

The Freemium model is important because it allows users within corporates to get started without having to go through any procurement or purchase processes and approvals. In addition, in many companies, employees no longer have admin rights on their computers and thus cant install software without IT approval. By making the SaaS solution work in common browsers SaaS solutions avoid such painful barriers.

And, of course, the Freemium model reduces the frictions of having to pay before being able to use the software for personal users as well. What good would it be if people could access a SaaS page easily on the web, if they had to pay straight away to use it. In today's time, not having any free features is almost unthinkable.

Freemium vs Free Trial

We should be clear what Freemium is to start with. Too many other things get confused with Freemium (even in reputable sources).

First, let's distinguish Freemium from Free Trial.

ClickUp is an exciting team collaboration SaaS solution. Looking at their pricing table we see a clear example of a Freemium.

It has a free layer and paid layers.

It's important to note that:

the free layer is for an unlimited period (otherwise it's not Freemium) and

that - therefore - it is limited in some way or form in its feature set compared to the other pricing layers

The image only shows a small portion of the feature set. But we know how it works because we have seen it in other SaaS solutions.

It’s important to have the right mix of single-user and collaborative features in your Freemium layer to support the spread within firms.

The cost of Freemium accounts are booked against sales & marketing in the cost structure.

Here we have a screenshot from Concur. It's a SaaS solution in the enterprise management category. It's now owned by SAP.

As you can see - they don't have a Freemium model. They have a Free Trial.

Two key difference from Freemium:

It is time-limited

It offers access to the full feature set (for the limited time)

Below is another example for a Free Trial from another exciting innovator: BambooHR and you see the same.

Always free (without paid layers) is not Freemium

Secondly, not everything that provides free access is a Freemium model! Some are stating that Google and Facebook and many others are based on the Freemium model (ouch).

These and many others are monetising on advertising which is a different business model altogether. Freemium is composed of the words (Free + Premium). I.e. there is always a "premium" (i.e. paid) layer involved. Google, Facebook and many others don't have this because they are monetising on ads.

Important business model characteristics of Freemium

Providing a free layer of useful functionality is important and we will elaborate more on why this is the case shortly. Here are some important things to know about the Freemium model:

It's a pricing or monetisation model. It is not a business model!

Freemium works for certain types of SaaS solutions and is often used by the SaaS categories shown on the left hand side of the mind map above

It is less suitable (and not used) by other types of SaaS seen on the right hand side of our mindmap, i.e., ERP-type software. These typically use free trials

Freemium works in conjunction with other business model elements as we will see shortly

Freemium is not a silver bullet and comes with risks (e.g. customers that never convert, very long sales cycles, costs, etc)

The Freemium pricing model has been used in combination with other sales & marketing tactics by certain types of young SaaS startups to great success!

Word-of-mouth & Bottom-up

Accessibility through common web browsers & removing key barriers to use (via Freemium) then play a key role in the next two key elements in the channels section: word-of-mouth and a bottom-up approach.

The big traditional players of software (the likes of Microsoft, Oracle, SAP), enter companies' IT portfolios from the decision makers that they long know. Their (sales) account managers have key contacts within all customer firms who they have known for many years. Through these key contacts they sell on new versions of their software as well as new products that they have developed. Nurturing these relationship via classical salesmanship is a key tactic.

For new SaaS startups who do not have these contacts & relationships, it's far more difficult trying to beat the big players with their own tools. That's why excising SaaS startups have come up with new tactics and playbooks in the sales & marketing space.

They enter firms from the bottom and then go up the hierarchy. They enter it via the users of their tools and not via the management layers.

These exciting SaaS firms do not leave this process to chance. It's worth noting the many links to the Value Propositions. These links make the channel processes of entering firms from the user layer an intrinsic characteristic.

Challenges to the R&D teams are to make sure that the SaaS solution's Value Propositions include:

Engaging to use

Self-explanatory

Immediate usability and ability to see immediate results (see also Valur Prop section)

You know what we are talking about because many of the SaaS tools that have made it are ticking off these requirements easily.

With all of this our key points for the Channels section of our business model canvas are:

Channels

Browser, App

Freemium model

Word-of-mouth

Bottom-up

Inherent properties of the tool

Learn more about the channels of digital business models here.

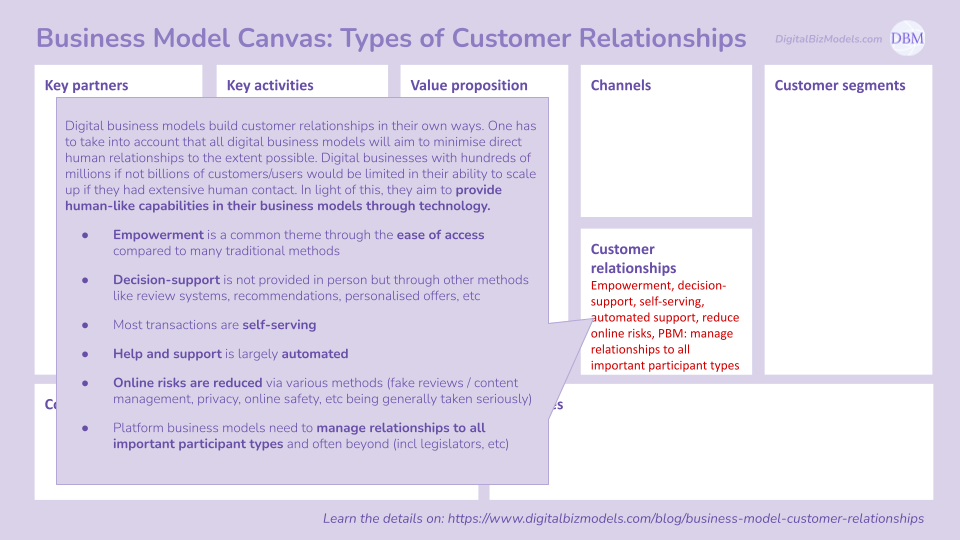

Customer Relationships

But this doesn't mean that SaaS firms let their great software do the marketing work, sit back and wait for the desired results to materialise by itself.

Freemium also enables a different type of customer relationships than traditional software. The Freemium model and usability in common browsers and its dedicated app sets off a process of self-adoption from the bottom up.

But this needs to be supported by the SaaS firm.

Help users succeed

SaaS firms support potential customers with resources and their support & success teams (even before they sign up), examples are:

Free, web-based help and educational resources

Communities of users

Customer success teams who support the super users

and more

Super users

SaaS tools are introduced to firms through early users who like the tool and start collaborating with others within their firm through the tool. Some of these early users become super users (or champions, trailblazers or whichever other fancy description is used).

The good news is that when SaaS firms support users, (some of) the users become ambassadors of the SaaS solution. Often these are extraordinary individuals within firms who believe in the SaaS solution. Of course, they hope to improve their career through the benefits that the SaaS tool provides. This is why it's crucial to help these individuals succeed.

Support the self-adoption process

By supporting early users, SaaS firms in essence support the self-adoption process within client firms.

The involved teams are called customer success teams (and not customer support which is a different function that is triggered by the customer whereas customer success should to quite a degree be initiated by the SaaS firm).

Salesmanship

And even with all of this in place, SaaS firms still use "traditional" sales & marketing activities. The human contact is still one of the most effective ways to close deals (esp larger ones). But SaaS firms don't pitch to the decision makers "cold". They use their salesmanship later in the process.

The work that the said SaaS tool champions have done is one of the best ways to pitch to the decision makers. These are highly relevant use cases developed organically and that now can be used to demonstrate the benefits to the decision making managers. No need for a 6- or 7-digit consulting job for an evaluation project as often seen in traditional ERP systems (which comes with its own approval process and often gets stuck there).

Learn more about the customer relationships of digital business models here.

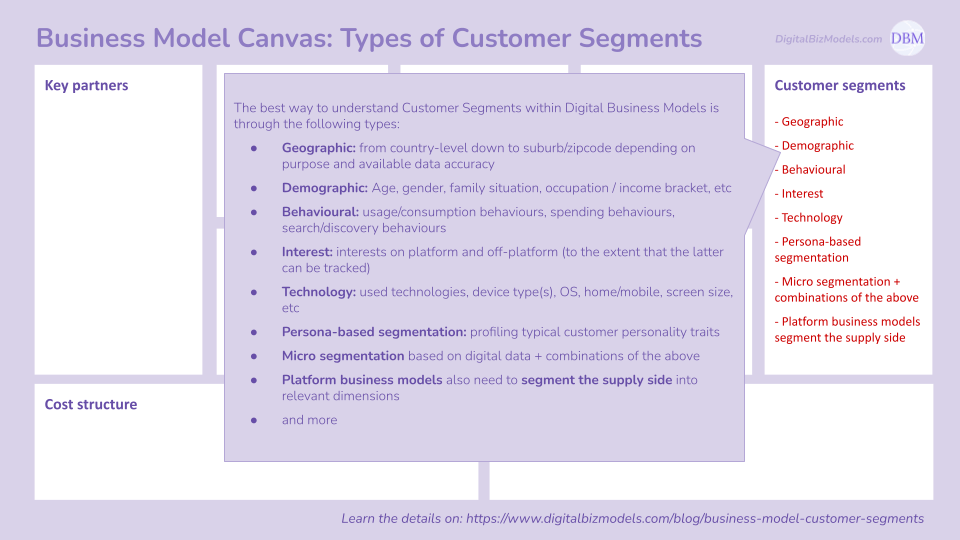

Customer Segments

We can slice and dice SaaS customers in many different ways. For example:

By their vertical: there will be big differences in how firms from different sectors use the same tool (e.g., a chip manufacturer will use a project management software very differently compared to a software development company, a marketing company or a bank).

Large vs small companies: there will be differences between large and small companies.

Within this there can also be different team sizes and this directly ties back to the pricing model of most SaaS solutions which almost always takes into account the number of users.

Individuals & small teams

Another important way to look at segments is the pertinent question whether the SaaS firm should give more to their current segments and strengthen those relationship and expand to similar types of customers or whether they should try to expand to new types of customers by developing new types of features.

Customer segments and value proposition trade-offs

Here is where the product roadmap comes into play. Many SaaS firms give users a voice in the selection of future product features (that said, it pertains only to a subset of the product roadmap). Here is one example.

It's a good idea (and common practice) to engage your customer in your roadmap. Here ClickUp's roadmap (in Trello)

Learn more about the customer segments of digital business models here.

Enterprise SaaS solutions

Before we move on to the revenue & cost structure parts of the business model canvas. Let us point out some considerable differences between the types of SaaS solutions that we have shown in the categorisation.

In this article, we have been mainly focussing on SaaS solutions on the left hand side of the mind map. There are also many exciting solutions in the enterprise management space shown on the right. There are considerable differences in the details of their business model canvasses.

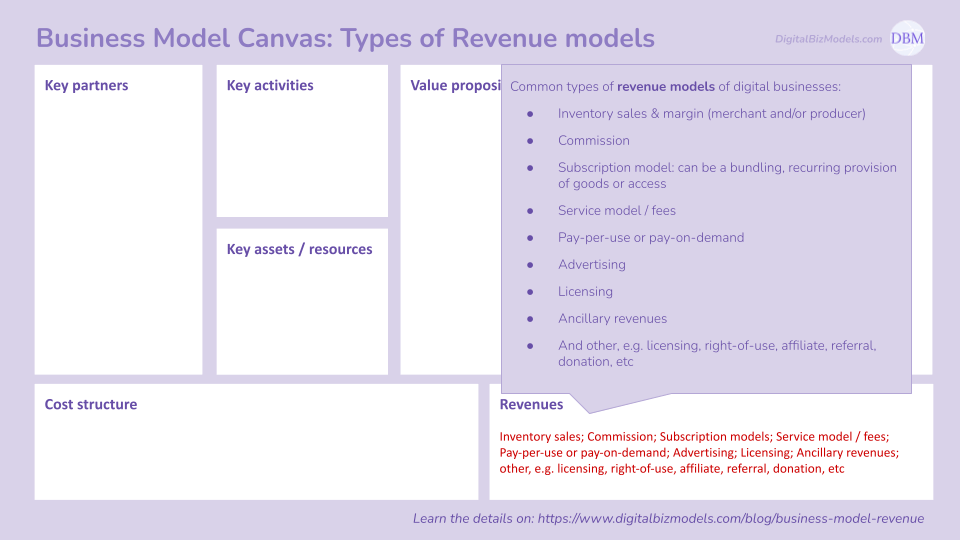

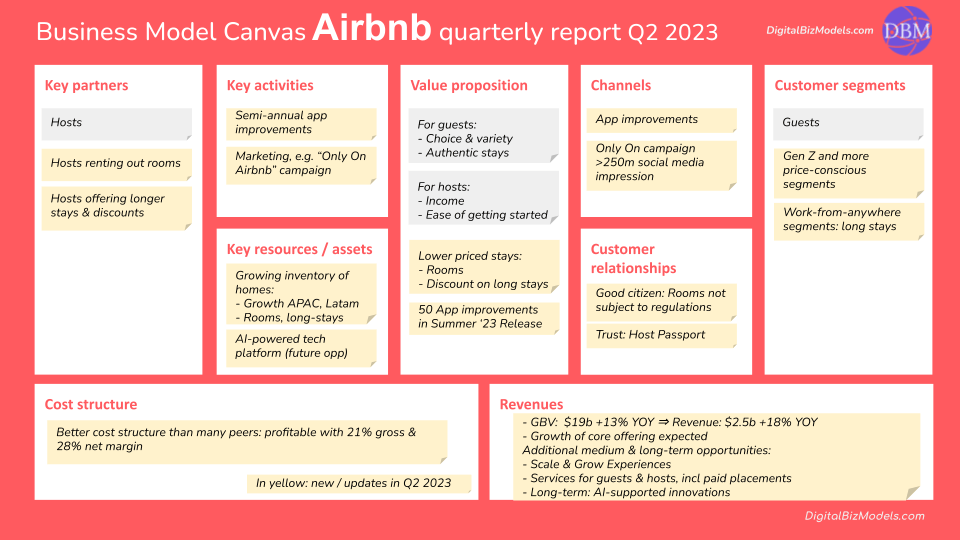

Revenue / monetisation

Now, let's look at SaaS revenue models.

In almost all cases, most of the revenue is generated based on subscription pricing, i.e. a recurring monthly/annual fee. In addition, almost always subscriptions are based on the number of users.

As for the SaaS solutions on the left hand side of the mind map there is basically always a freemium layer. Enterprise SaaS does not offer this.

Then there are typically 2-3 paid layers with a clear pricing. Often it's differentiating between small teams/firms and larger ones based on the premise that larger teams need more extensive functionality

Lastly, we often see an additional layer that has customised pricing because it offers customisable security, auditabiility and other admin features often of interest for large enterprises

It is an interesting question which of the customer segments generates the largest revenues. As for Slack the answer was that the largest few customers generated a very big share of revenue. And this will be similar for quite a number of SaaS solutions.

We do notice a number SaaS solutions adding commission or transaction based offers. It's early days in this space but it's also very exciting to see where it will lead and whether some of the SaaS firms will manage to generate considerable revenues based on the platform business model.

Learn more about revenue generation in digital business models here.

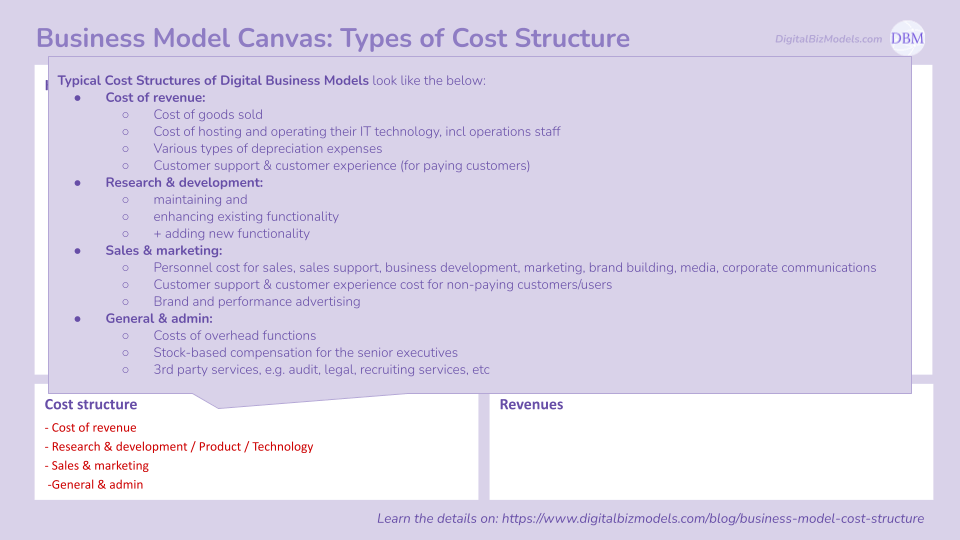

Cost Structure

The typical cost items in a SaaS cost structure are:

Sales & marketing

Research & development

Cost of revenue

General & admin

As already mentioned, sales & marketing can often be the largest cost item in the scaled state.

But it is also interesting to see the development of cost for a scaling company. Let's that the example of Slack which we think is quite typical of similar SaaS companies. They launched in August 2013 and had their IPO in April 2019. Some interesting observations are:

As late as 2 years prior to their IPO their Sales & Marketing (S&M) costs still stood at 99% of their revenue which was ~$100m.

And it still consumed 58% in the FY ending 3 months before their IPO.

R&D stood at 92% of revenue 2 years prior to their IPO and 39% in the lead up to the IPO

Note that we can’t use the post-IPO data because it includes large amounts of stock-based compensation for the sales & marketing as well as the R&D folks distorting what was actually spent in that year. The second year post-IPO is more useful but still can have stock-based compensation

It still makes the general trajectory clear for those who make it to an IPO

Learn more about the cost structures of digital business models here.