Business Model Canvas: Key Partners

This article will cover the various types of Key Partners that we typically see within digital business models along with a rich set of examples.

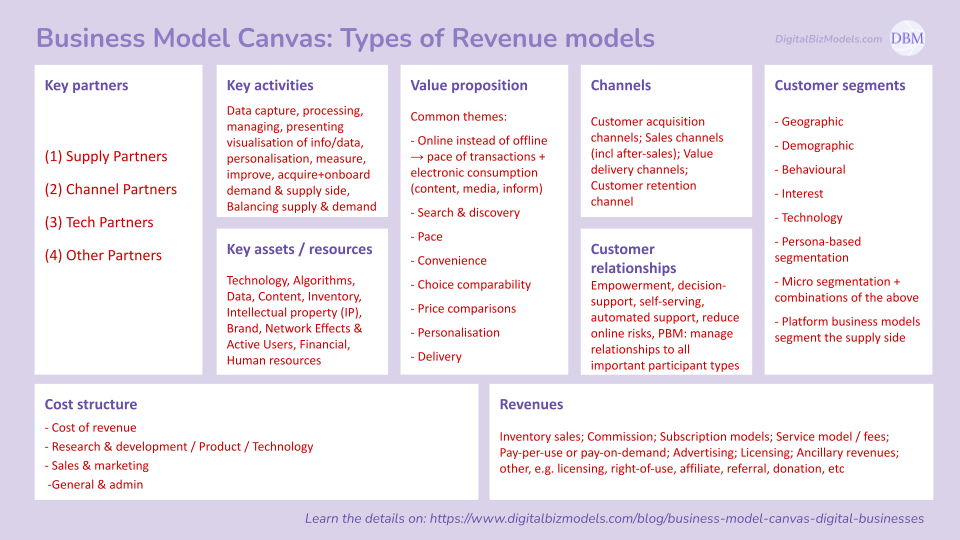

Key Partners are one of the sections of the popular Business Model Canvas tool.

The Business Model Canvas was devised by Alex Osterwalder.

Types of Key Partners

Looking at the Key Partners of digital businesses we first need to distinguish between different types that we will elaborate on throughout this article.

(1) Supply Partners from which the key inputs get sourced. It is important to note the significant differences among vertical-specific supply partners which is why we are providing an extensive list of examples in this article

(2) Channel Partners can be involved in customer acquisition, retention and value delivery

(3) Tech Partners providing components of the key value creating assets

(4) Other Partners for all sorts of aspects of the business model, e.g. investors, legal, professional service and many more. These are not further covered here.

Let’s look into the details for each of the first three types followed by many examples.

Types of key partners within digital business models shown in the biz model canvas

(1) Supply Partners

Supply partners are those that the digital business sources their Key Inputs from. This brings us to an interesting point…

Key inputs

Key inputs are the components that the offering and value proposition of the digital business is made of.

Now, for some unexplained reason the business model canvas does not have a section for key inputs. Key inputs are crucial for any business model. Every business management scholar, school and course will teach you this. The BMC does not have it. For some reason they directly jump into the key partners so let's take a step back and just list for different verticals some of the most crucial inputs to the value creation aspect of their business model.

Here are some vertical-specific key input examples:

For ecommerce key inputs are the inventory of goods that they source and sell to the customer

Online travel sources inventory of hotel rooms and flights

Service platforms (e.g. Fiverr, Upwork) source human skills and labour which they offer on a marketplace

Asset & service sharing platforms (e.g. Uber, Airbnb) source durable assets along operated by the owner

Search platforms crawl, analyse and organise websites which become their organised inventory

For Software-as-a-Service (or SaaS) businesses inputs are, SDKs, APIs, libraries, etc and the broader tech stack

Hardware-software tech businesses source electronic components as well as software components to combine them to an end product or underlying platform

Health tech and Ed tech platforms source intellectual property (IP) and expertise, e.g. for telemedicine, education, etc

Fin tech platforms manage financial assets and use financial data, information and IP to create the desired outputs

Supply Partners

Key inputs are provided by and sourced from Supply Partners which are one of the most important types of Key Partners. We will provide a large set of vertical-specific examples of supply partners in a moment.

(2) Channel Partners

Different types of channel partners include:

Inbound / outbound delivery channel partners can include transport partners or delivery partners etc

Customer acquisition channel partners involved in the acquisition of customers

Value delivery channel partners are involved in the delivery of value to the customers

Affiliates / affiliate-type partners: Are partners involved in selling our value proposition to the customers

Commercial partners can include various types of partners on the input side or on the selling side

We will show some examples of the above in a moment.

(3) Technology Partners

Technology partners are involved in the value-creating assets of the digital company. However, it makes sense to further distinguish:

Technology partners: We should distinguish between technologies that are accessible to several competing companies within the same vertical and those that are not. In the former case, it becomes a non-distinguishing factor in terms of competition. In the latter case, it can be a competitive advantage albeit a temporary one. But front-running competition on the right set of technologies can still be a strategy.

Let's use the common example of hosting: the first ones who used the cloud (AWS) had an advantage because of cost as well as flexibility etc. But these days all startups are on the cloud, so that there is simply no distinguishable advantage anymore

Another common example are maps: 10 years ago if you had a good map integration you certainly had an edge but these days there is no further advantage unless you have some sort of bad integration thereof (which means you’re at a disadvantage)

R&D Partners: R&D partners are those that collaborate with Digital companies on longer term opportunities. Here we are not talking about technology integration but about long-term research projects. Take as an example Uber’s autonomous vehicle endeavours. This used to be an integrated partnership but now it is an external partner that Uber collaborates with. This is a pretty common approach to R&D unless you are one of the very big companies. The probably most prominent example right now are Metas Reality Labs who try to build the Metaverse.

And what about Artificial Intelligence (AI)? Good question, firstly it would sound like an important key partner, however, typically digital tech companies use APIs and libraries such as ChatGPT but the real knowledge is in the parts that the digital company develops themselves. It is decreasingly less in the underlying AI algorithms because now these have been made more accessible to companies than even 2-5 years ago.

Vertical-specific Supply & Key Partners

Now let’s take a look at examples of supply partners and other key partners. The best way to do so is by looking at concrete, vertical-specific key partners.

eCommerce

Examples of key partners in eCommerce (think of Amazon, Etsy, Wayfair and thousands of others) include:

Supply partners:

Traditional suppliers and manufacturers including wholesalers are Key Partners for purchased inventory. These fall under merchant business models

Manufactured inventory: Some e-commerce players May manufacture their own inventory. For example, Amazon owns a range of brands which manufacture their own products

Platform biz model eCommerce (e.g. Amazon Marketplace, Etsy, Wayfair) sell inventory owned by supply side participants of the platform. This inventory is not on the company's balance sheet

Channel partners:

Inbound transport partners: Supply chain & logistics firms

Outbound transport partner: Delivery firms

Content & Media

Examples of key partners in Content & Media include Netflix, YouTube, Spotify, Medium, Apple News and many more:

Supply partners:

Content & Media companies purchase and licence content & media from rights holders

Purchased content: Netflix still purchases a portion of their content though this is now clearly a small portion.

Licensed content: Spotify and YouTube Music licence considerable parts of their content from

Copyright holders can be key partners say where Netflix sources script that they use for self-created content or licence IP for eg Marvel characters

Content creators (supply side of platform biz models): Medium, Apple News, Twitch, YouTube have a considerable portion of supply-side created content

Other partners:

Then we can have Channel partners. Customer acquisition channel partners in the content & media vertical include:

Prizes and film festivals

Media outlets (TV or web), magazines, critics, etc

Sharing economy

Examples of key partners in Asset & Service Sharing (=Sharing Economy) include Uber, DoorDash, Airbnb among others:

Supply side partners:

Uber / DoorDash:

The drivers are on the supply side of Uber's business model. A sufficient number of drivers is essential to provide the customer proposition (timely pick-up at low cost).

Restaurants, shops, etc: Like drivers, restaurants are another key partner crucial in the value proposition of delivery

Airbnb / Vacation rental platforms:

Hosts bring their properties and/or services to the table. Achieving a critical mass of supply and variety of choice is important for the customer value proposition.

Customer acquisition channel partner include:

Access point partners (acquisition channel): Airports, malls, landmark & attractions, etc:

Uber commercial partners, partnering hotels who may summon drivers on behalf of their guests,

Airbnb commercial partners: collaborating with tourism bodies to stimulate demand (often through marketing collaborations),

Online Travel

Examples of key partners among Online Travel Agencies (OTA) include Booking.com, TripAdvisor and Expedia:

Supply partners:

Hotels and airlines are supply partners from which online travel agencies source inventory (hotel rooms and seats on flights). This is the case in the merchant model

In the agency model (platform biz model), OTAs dont source inventory. Hotels put up rooms for booking and the OTA gets a commission on bookings

The same (agency model) holds true for vacation rentals, attractions, events

Channel partners:

Affiliates: The larger OTAs run an affiliate program through which those websites make a commission that originate bookings

Social Media & Search

Examples of key partners among Social Media includes Meta’s Facebook, Instagram, X. Examples of Search Platforms include Google, Bing and others.

Supply partners:

Businesses, such as Brands, Businesses, Influencers, Media/News, Blogs, Creators who supply engaging content

Channel partners:

Customer entry point / traffic channel partners: iOS, web browser, etc

Software-as-a-Service:

Software-as-a-Service examples include Salesforce, most Adobe products and hundreds of thousands more cloud-based software products:

One of their key partners are integration partners which can be categorised as value delivery and customer acquisition channels

Critiquing the Biz Model Canvas (Key Partners section)

Now that we have covered the key partners section of the Business Model Canvas (BMC), it’s also time to discuss honestly some shortcomings of the BMC relating to this aspect.

Where are the key inputs? Inputs or Key Inputs are a crucial aspect of business models and it is strange that such an aspect is omitted. We have seen many examples above and having this category would enable us to distinguish between various sourcing models for the same key inputs which often drive crucial differences between competing business models.

There is no other place in it for the different types of partners in the Business Model Canvas. From a business model and value creation perspective only the Supply Partners should be in the Key Partners section of the BMC. However, for the lack of other places in the BMC all sorts of partners (incl channel partners, asset-creating tech partners) also get added (by practitioners and bloggers) to the Key Partners section. This often leads to an indiscriminate laundry list of partners that are involved in different parts of the business model. The BMC wants it to be read from left to right in terms of value creation. Adding key partners involved in all other aspects is not helpful being able to spot value creation within the BMC at a glance.

One could add more to this list but we have been using the BMC extensively on our pages and thus want to also remain moderate with our commentary.

We hope you enjoyed our coverage of Key Partners including the differentiation of different types of partners and extensive list of examples involved in digital business models.

What we like more than the Business Model Canvas: the B-MAP

We have used the business model canvas for almost 10 years on a very regular basis and to cover many dozen companies. Over time, we have realised that it has its limitations.

That is why we have decided to use a presentation format based on the time-tested Value Chain method devised by Strategy Professor Michael Porter. It is a far better way to grasp key aspects of a digital business model than the canvas.

Prof Porter is the most cited scholar on competitive strategy and digital transformation (with almost 10x more citations than the respectively 2nd ranking scholar).

Our Business Model on A Page (B-MAP) is specifically developed for digital business models and based on the Value Chain.

We have decided to price our B-MAPs super-affordably to give everyone (including our many valued followers from lower-income countries) the opportunity to get kick-started on their innovation journey with this high value resource that includes a B-MAP + walk through video for each of the digital companies that are covered!