Microsoft Office Business Model

Microsoft Office is now Microsoft 365 but for the sake of familiarity, we will often use the more familiar term “Office”. It is a subscription service that provides access to Microsoft's productivity applications (cloud-hosted) and related services. It includes Word, Excel, PowerPoint, Outlook, OneDrive, Teams as well as related services pertaining to security, file storage and communication tools.

From a business model perspective, Microsoft Office is Software-as-a-Service (SaaS). We have covered crucial aspects of SaaS Business Models extensively here.

With that it falls under the Linear Business Model that all SaaS biz models are based on.

How is Office / Microsoft 365 monetised (Revenue model)?

Over the recent years Office has moved increasingly from a desktop-install model to a cloud-based solution. With that the revenue model moved from an inventory sales (or one-time licence fees) to a tiered (recurring) subscription model.

The different tiers include Personal/Family, Education, Business and Enterprise. As is often the case with enterprise tiers, there can be various types of related services involved delivered by Microsoft or one of their partners.

In addition, Microsoft offers a limited feature set via their Freemium layer as part of the customer acquisition funnel.

Value Proposition

Office’s value propositions include:

Productivity via a vast set of functionality (exceeding most user’s knowledge of the intricate details)

Accessibility & familiarity

Increasing set of collaboration features (for teams & businesses), such as concurrent editing, review / commenting, etc

Compatibility - one can still send documents as downloads that others can open on their computer outside of the author’s organisation

Ongoing support and security: ongoing bug fixes (eased by the cloud-model), improvements and ongoing improvement of security levels

Microsoft Office Business Model & Value Chain in one view

Value Chain

Now, let’s discuss Microsoft Office’s Value Chain.

From a Business Model Canvas perspective all of the below is part of their key (value creating) activities.

1. Development of features and new apps

Microsoft Office 365 Research & Development includes a number of aspects:

Development of new features and improvement/maintenance of existing features which as part of ongoing improvement

It also includes the development of new apps from time to time - the Business Premium layer of Office 365 now includes over one dozen apps

In addition, where we see “real” R&D is the integration of AI into the products where they have to develop and enhance proprietary AI models

Sourcing of software components: Microsoft develops many aspects of their software in-house for IP (intellectual property) reasons. However, they too partner with others or may use leading technologies. The best example is OpenAI (the underlying technology for ChatGPT) that Microsoft invested $1b in 2019 and $10b in 2023. While ChatGPT is its own technology, it’s also clear that AI functionality will be increasingly integrated into the Office Products (check our Google Biz Model Video to see some AI ideas that Google has to this end)

2. Infrastructure & Operations

Office is mostly delivered via their own cloud infrastructure

They also use partner infrastructure in some locations and for certain aspects, notably this includes Content Delivery Networks (CDN) networks for delivering images and videos efficiently

Their cloud infrastructure makes their Office solutions scalable for their business customers as data and computing capacity needs grow

The cloud architecture also allows a more integrated and convenient roll-out of new features from a customer perspective

In addition, it brings faster / more convenient deployment cycles from a security perspective but may also raise concerns regarding data privacy

From the perspective of the business model canvas, key assets include: their underlying cloud infrastructure (from data centres to delivery infrastructure), their proprietary software code for the apps, the various types of data and more which are key parts of this value chain step.

3. Sales & Marketing

Microsoft leverages extensive sales & marketing activities that include various direct and indirect activities. Some of the key aspects include:

Their direct marketing activities include: brand media ads, digital performance ads (search & social), content marketing and more. In addition, they offer product demos, webinars and case studies.

In addition there are community-based marketing activities via online groups and forums, developer communities and events and more

Direct sales channels include (field) reps who have long-standing contacts with a large set of business customers and are on the lookout for new ones. Direct channels also include Microsoft’s websites, their own App Store and their wider set of website

Indirect sales channels can include value-added resellers (VAR / OEMs = original equipment manufacturers, e.g. laptop manufacturers, etc), System Integrator, Online Resellers. In addition, there are the various App Stores (Apple, Google Play Store, etc). Among the various other approaches Microsoft Partner Network (MPN)

4. Value delivery

The cloud-based value delivery infrastructure that we discussed above is the centrepiece of Office’s value delivery.

It allows users accessing their Office documents on various devices, including their personal / work laptops, tablet devices as well as mobile phone

In addition, they can access their documents via web browser where this is more convenient in some circumstances

The cloud-based architecture allows sharing of documents via links which solves the problem of different versions of the document floating around on collaborating user laptops with a need to bring such revisions back together to one

Office has become a genuine real-time collaboration tool across all the Office apps

In addition users can use a vast ecosystem of add-on tools developed by 3rd party players via the Add-in menu built into the various Office tools. Some of the most popular add-ins include Grammarly, Zapier, PowerBI (also owned by Microsoft) or Tableau, Lucidchart and many other

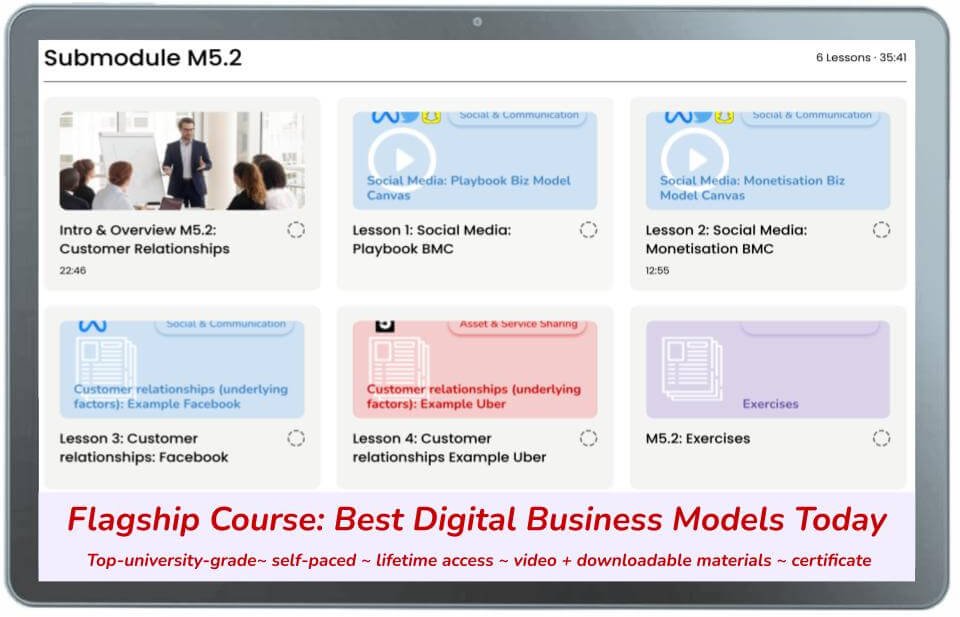

Check out our Flagship Course

5. After sales & user support

Office’s support channels and activities a extensive and extend across the different (major) customer segments. Key aspects include:

Implementation support for business customers directly and/or via their extensive partner network. This includes configuration, data migration and integrating with existing systems (data exchange, security, etc)

For users Microsoft provides extensive built-in help systems, online resources (knowledge base and online guides), tutorials and live support

Further for users: training programs, webinars, video tutorials and certifications

Enterprise customers have technical support, e.g. in case of downtimes/issues (via agreed SLAs - service level agreement), maintenance work, etc

6. Improvement cycle

Usage data data and analytics as well as market / competitor observation is used for the planning of the roadmap of features and new apps

Microsoft collects usage data within Office

User feedback including bugs and issues as well as liked features

Market / competitor observations

Developer / “super” user feedback as well as corporate user feedback

Microsoft publishes Office’s roadmap here with almost 2,000 items as of the writing of this article and their projected availability dates.

In addition, they have their development teams and decision making governance (under inclusion of senior decision makers) about big decisions such as the inclusion of new apps to Office.

Software-as-a-Service Business Models

We hope you enjoyed this. However, keep in mind that this article is only a high-level introduction to the topic of Software-as-a-Service Business Models which Microsoft Office falls under.

Learn more about Software-as-a-Service SaaS Business Models here.

You can learn even more about the various aspects of Digital Business Models in our Flagship Course with a dedicated submodule on SaaS in M6.1.