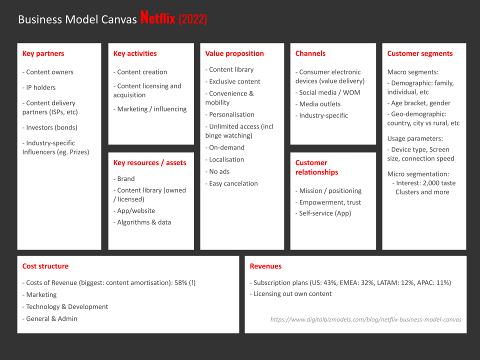

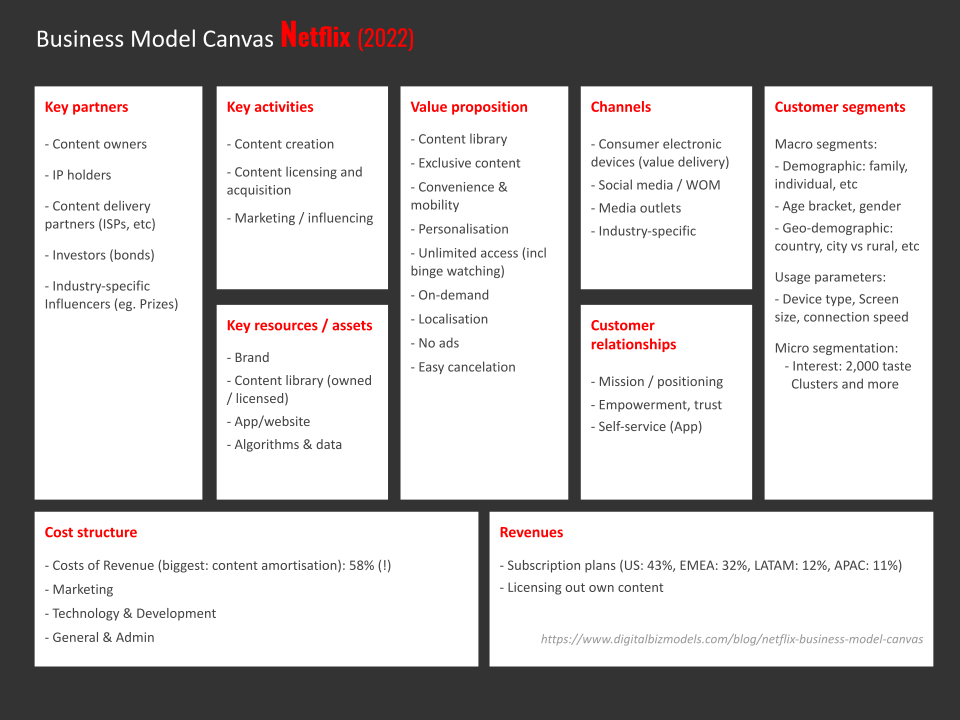

Netflix Biz Model Canvas

Netflix is based on a linear business model that monetises on subscription revenues (tiered plans) and is one of the biggest players in the Media & Content vertical in Digital Technology.

“Netflix is one of the world's leading entertainment services with 233 million paid memberships in over 190 countries enjoying TV series, films and games across a wide variety of genres and languages.” Netflix.

Key Customer Value Proposition / unique selling proposition

Netflix’ key value propositions & unique selling proposition are based on providing engaging digital content (movies & TV shows) in convenient ways (TV, laptop, tablet, mobile phone) that can be consumed on-demand and that is not interrupted by ads. More recently Netflix introduced a cheaper layer for those who accept ads - but a majority of users are on the ad-free plans.

Value Creation

Value is created through a linear process where most inputs are sourced and then processed to digital media content within the firm. Netflix-created shows/movies make up a majority of their content. This fact is a hallmark of the linear business model as Netflix runs it and a major differentiator from YouTube.

Digital Content & Media vertical

Broadly, speaking digital content & media business models leverage the linear (Netflix) as well as the platform biz model (YouTube, Spottily, Kindle) to provide access to goods that once were distributed on physical media. Amazon Prime Video is a hybrid in that they have a considerable amount of their own content (linear biz model) but also allow subscriptions to other channels via their front-end (Platform Biz Model). Most types of content & media: Fiction / non-fiction books, magazines, music (semi-pro / professional), videos, movies and more are now available via digital channels (probably one of the major exceptions are educational textbooks).

Overview

This article is structured in line with the elements of the business model canvas:

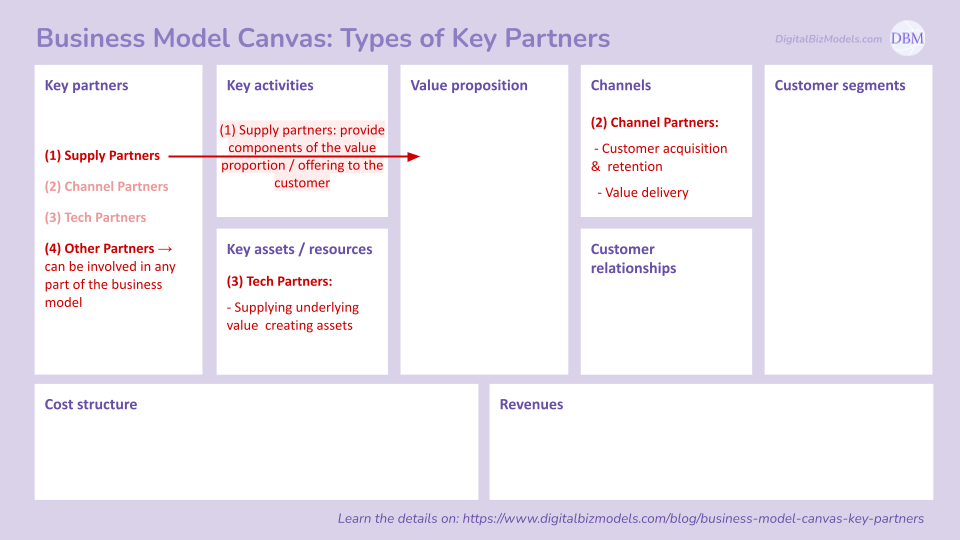

Key Partners

Primary partners: Netflix has become much more self-sufficient in that most of their content is now self-created. Previously, they were far more reliant on favourable terms on licensing (and purchasing) content. This dependency has reduced quite a bit. Nevertheless, these should be considered primary partners.

Content/IP owners (studios / distributors): shows and movies that Netflix acquires or licenses from 3rd parties

IP holders: such as Marvel and others who can license their IP to Netflix for their own content creation. Some of this content has done very well. Even where Netflix creates their own content based on this IP, they are depended on getting acceptable terms with these partners . In addition, Netflix is entering into this space themselves with the acquisition of Millarworld.

Investors: Oddly enough, Netflix is still somewhat dependent on investors. Not so much on stock investors (though of course they dont mind a bump in their share price). But stock issuance is a negligible way to get cash in the door. But bonds still play a huge role. Sure enough, Netflix can always get cash in the door by issuing bonds. But it the interest rate (also called coupon rate) of the bonds play a role for the ongoing interest expense. This cash then is used to create content.

Content delivery partners: Need to also be considered as primary partners given the outsized importance and the strangely fickle nature of it. Ordinarily, one would think that these are infrastructure partners and thus of lower significance. Netflix consumed 15% of internet traffic in 2019 and close to 20% in the US. These are pretty staggering figures for just a single company. But they are and will be coming down with the emergence of many other streaming services. It shows however the importance of this infrastructure layer. You also note the difference to the Uber Business Model where we didnt include tech (or infrastructure partners) in the primary partners.

Internet Service Providers (ISPs): are essential to the delivery of the content in “real-time” to the end customer (and simultaneously to millions worldwide in case of new launches) via Netflix Open Connect standard. But there are tectonic shifts happening (in the US market) that may pose a threat to Netflix (note, the described Comcast and 21st Century Fox merger didn’t happen, rather Disney who are not an ISP bought major Fox assets. The described threats, however, are still simmering)

Regulators: Policies of the Federal Communications Commission (FCC), esp on the topic of net neutrality can have a crucial influence on Netflix (and the entire industries) trajectory, including swaying M&A (dis)approvals / anti-trust dealings of the FTC (here is one opinion piece – note the emphasis on opinion). We wouldn't refer to them as "partners" but they are an important stakeholder. This area is - and always was - a heavily-lobbied space.

Amazon Web Services (AWS): Almost all of Netflix IT is hosted on AWS (from a functionality perspective but not from a content perspective). They also use Amazon’s Content Delivery Networks (CDNs). We wouldnt include AWS as a primary partner but it's listed here for completeness sake.

Learn more about key partners in digital business models here.

Our Flagship Course

Secondary partners: There is a micro cosmos of wider "partners" (stretching the limits of this term) and influencers whose opinion on individual titles can play a role (though nowhere as much as many of them may think of their "esteemed" views). The whole space is literally a vanity fair in which Netflix has fared surprisingly well for a tech company led by an engineer (a lot of the success in this field is probably to be credited to Ted Sarantos and others).

Prizes and film festivals: Strong promoters and influences in the industry can help get the word out, e.g. Film Academy (Oscars), Cannes Film Festival, etc. Netflix titles ran at the Academy Awards and won some prices anyway

Influencers: Magazines, TV shows and others covering the film industry can give free promotion (or criticism)

Filmmaker “guilds” and individuals: Directors, actors, writers and their guilds/unions are some of the most powerful players in the (US) film industry

Cinemas, Theatres: E.g. the ban on Netflix films at the Cannes film festival was a consequence of French cinema owner’s protest against Netflix practice not to show their content on theatre screens (but Netflix has recently made an interesting move in acquiring one of the title winners of Cannes)

Netflix Business Model on a Page (B-MAP)

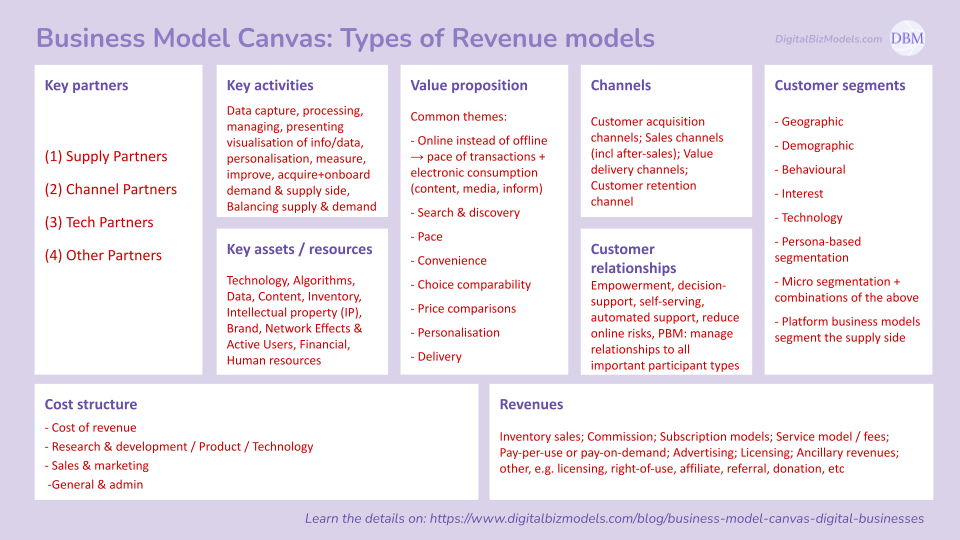

The Business Model Canvas may be an acceptable tool to describe traditional offline business models. But it has major limitations when it comes to Digital Biz Models.

We have developed the Business Model on a Page (B-MAP) format to explain in crystal clarity the business models of digital companies, especially the core value creating aspects.

What’s more we have decided to make our B-MAPs super affordable at $3. Our contribution to get your innovation journey kick-started in just 30 minutes!

Check out the Netflix Business Model on a Page (B-MAP) + a 20-minute walk through video with explanations at an unbelievably affordable price - learn more …

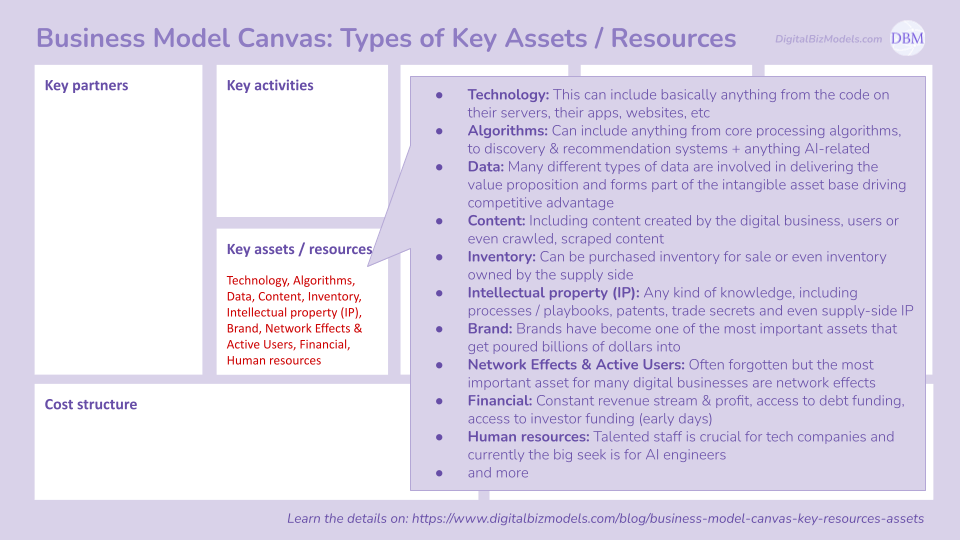

Key Assets & Resources

The Netflix brand: while Netflix primarily promotes their new shows, they still build a brand through this type of promotion. They rank within the global top 100 brands

Content library – Netflix-owned content: (created or acquired) can have a more extended life cycle in that they can re-run after being fully amortised (i.e. generate revenues at no costs – any firm’s dream). They can also be licensed out to other content distributors and generate revenues that way

Content library – licensed content: licensed content still plays a big role, esp those evergreen series that are already well-known. A number of other streaming content providers, however, have announced they will stop their licensing to Netflix. Larger studios have their own plans to build streaming libraries. Reducing their dependency on others is one of the reasons why Netflix is pouring so much money into acquisition and creation of content

The app / website: the key resource to deliver the experience and content

Algorithms: constant analysis of data based on algorithms and improvement of the business, app, features, etc

Recommendations: falls under algorithms but is such an integral part of Netflix’s success that I call it out separately

Data: Captured data, such as behavioural data, preferences used e.g. for micro-segmentation into 2,000 taste communities and used for future investment decisions into content among other

Technology staff: technology is what made Netflix a streaming provider (they started as a DVD-mailing company) and you can see they are valuing their tech staff by their stock compensation schemes that go into this

Actors, writers, filmmakers: Netflix often uses indie and newcomers across these activities and gives them more creative freedom. With many other streaming providers ramping up their content creation it will be interesting to observe the supply/demand shift in this area

Prices: winning revered film prices is one of the best ways to promote their movies and platform, esp because this is exclusive content that people can only watch when they have access

Studios: Netflix has started acquiring their own studios and hiring staff in support of content creation

Learn more about key assets & resources in digital business models here.

Free Downloads

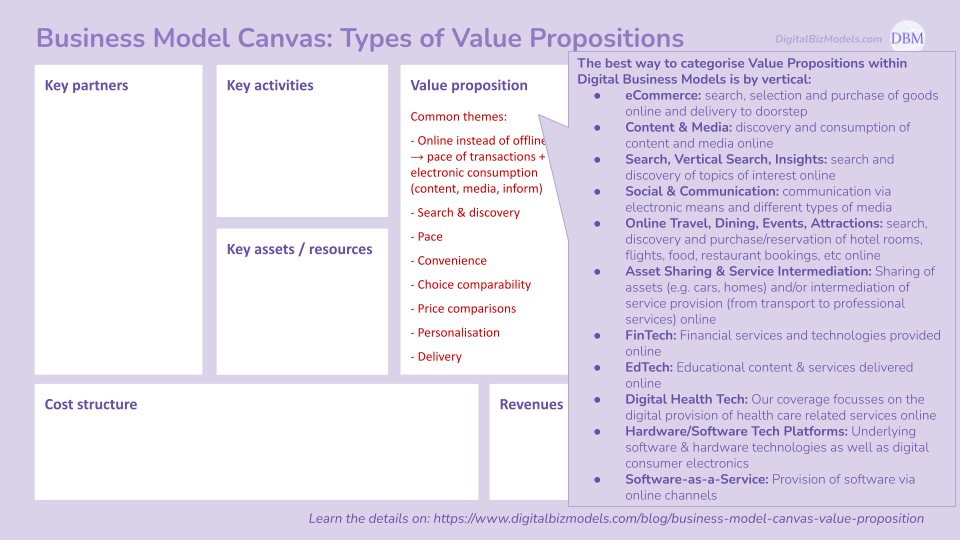

Value Propositions

Netflix’ key value propositions are based on providing engaging digital content (movies & TV shows) in convenient ways (TV, laptop, tablet, mobile phone) that can be consumed on-demand and that is not interrupted by ads. More recently Netflix introduced a cheaper layer for those who accept ads - but a majority of users are on the ad-free plans.

Content library: a huge content library ("Unlimited Movies, TV shows")

Exclusive content: the most important category of content is exclusive content. All content platforms aim to have highly-desired exclusive content. It is also the category that they will make the most advertising for. (The countervailing risk is that some customers will come only for one show, binge-watch and unsubscribe until new seasons are available.)

Convenience and mobility: ability to watch anywhere and on "any" device. One of the advantages that Netflix has over many other (esp emerging streaming) competitors is their "installed--base" on a wide range of devices, such as "Smart TVs, PlayStation, Xbox, Chromecast, Apple TV, Blu-ray players and more."

No ads: no ad interruption just when it gets interesting

On-demand consumption: Unlike TV, one does not have to wait for a week for the next episode. Users can watch anytime

Ability to binge watch: They can also binge watch. All episodes of one season of a series become available at the same time. This is a great stimulus for customer advocacy and word-of-mouth

Simple pricing: Using a flat fee (3 plans to choose from) with unlimited access, no tiers, no premium content at additional charges, no pay-on-demand, etc

High-quality connection: the Netflix ISP speed index has become a benchmark for measuring connection speed. Netflix uses pre-positioning of content during non-peak hours, CDNs and other ways to get their content to geographically close to their consumers

Free trial: Free month to trial – in this period everything can be accessed (no premium content, features, etc that are excluded)

Easy cancellation: "Cancel at any time."

Personalisation: through a recommendation system that takes into account what each individual has watched and liked before (rather than a static “if you liked this, you may like that”)

Localisation: Increasing amount of localisation through translation (subtitles) not taking into account the fact it needs to ensure the meaning is translated (not just the words). Creation of international content (not just pumping out US shows)

Learn more about the value propositions of digital business models here.

Exclusive content plays a great role in competitive advantage & diversification from competition esp in the fast-growing space of ever-new streaming providers and rights holders entering this space

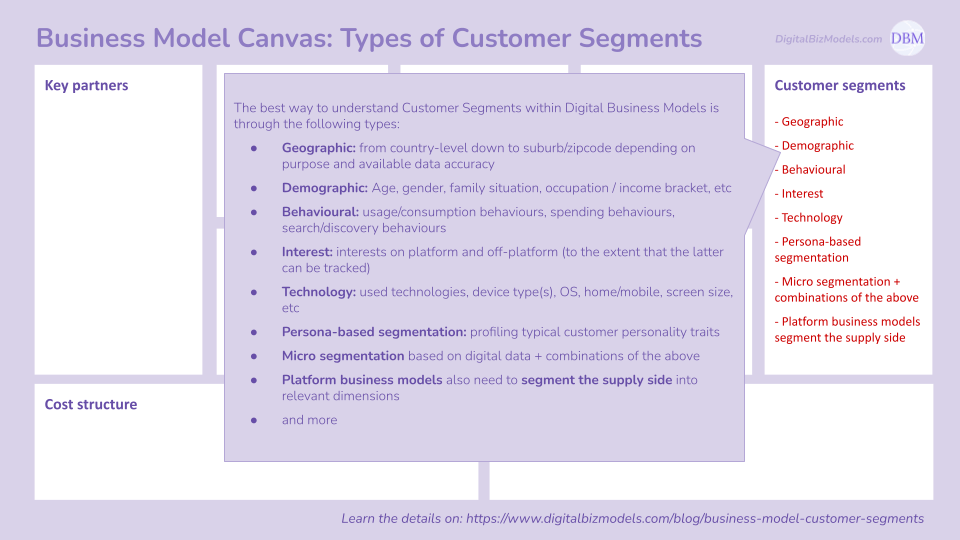

Customer Segments

Micro segmentation into 2,000 taste clusters determined by viewing history

Macro segments used for ad targeting (non-users), e.g.:

Demographic: family, individual, etc

Age bracket, gender, etc

Geo-demographic: country, city vs rural, etc

Language spoken, proficiency

and many others

User segmentation based on usage parameters:

Technology:

Device type TV, laptop, Tablet

Screen size

Connection type/speed

Viewing behaviours, e.g. home, on-the-go, weekend/weekday patterns, binge watcher, etc

First show/movie watched after subscribing

Browsing behaviours: repeat watcher vs explorative

etc

Learn more about the customer segments of digital business models here.

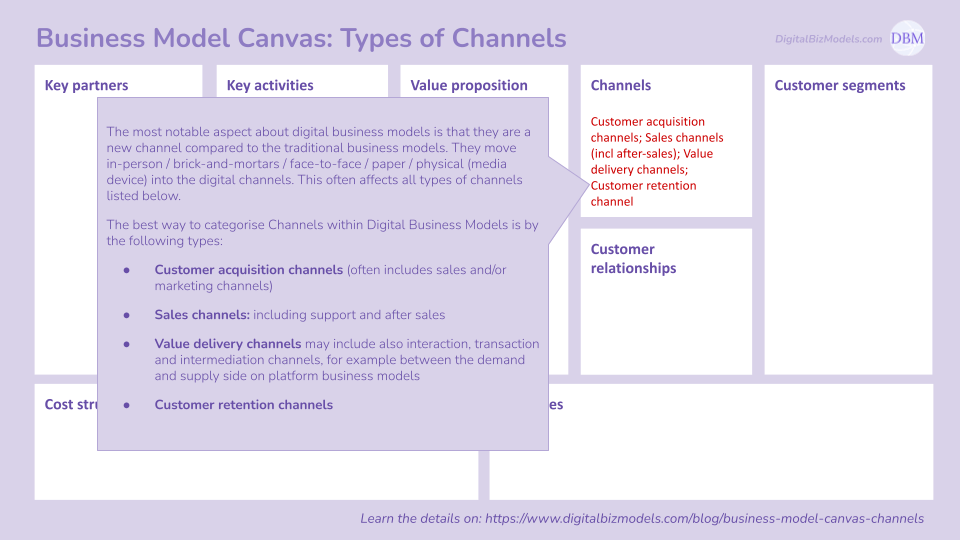

Channels

Netflix uses (like many other digital tech companies) thousands of channels directly and indirectly with more or less control for customer acquisition, retention and value delivery:

Their value delivery channels include many types of smart consumer electronics:

Those with a screen, connection and computing capabilities: Smart TVs, smartphones, laptops, tablets and more

And those with connection and computing capabilities, such as game consoles, set top boxes and more

Customer acquisition channels include:

Social media for customer relations / promotion of upcoming shows/movies

Media outlets to spread the word (magazines

Film festivals for promotion

Learn more about the channels of digital business models here.

Netflix Business Model Canvas

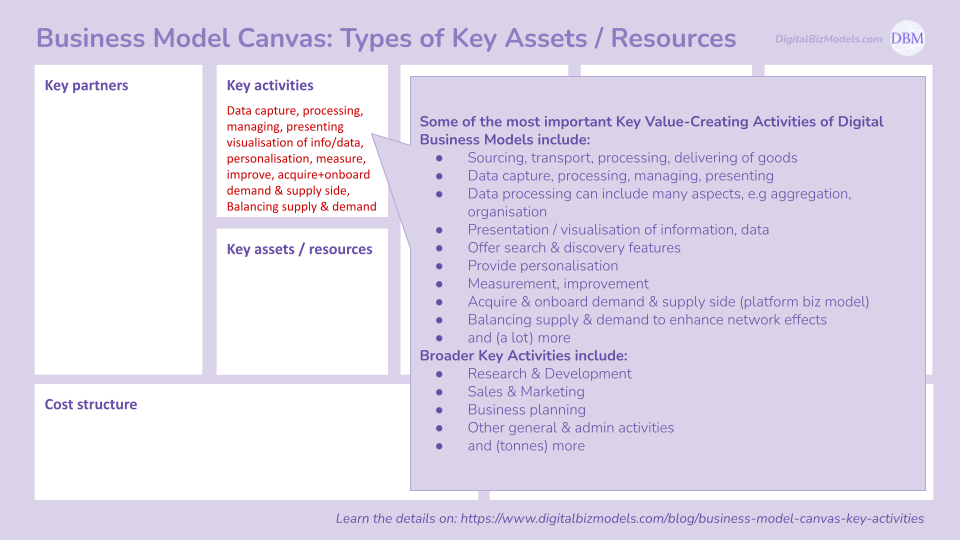

Key Activities

Creation of original (exclusive) content: is one of the most important activities. As more and more streaming services emerge, one of the most important factors of competitive advantage is the exclusive content on each service

Sourcing of 3rd party content: While the share of 3rd party content has reduced over time, it still plays a role

Development of new offerings: developing new offerings, pricing tiers and revenue sources is very important as has been witnessed by the nose-dive ans somewhat-recovery of the share price in 2022/2023

Marketing: marketing will always play a huge role and is conducted via different channels & methods

Learn more about key activities in digital business models here.

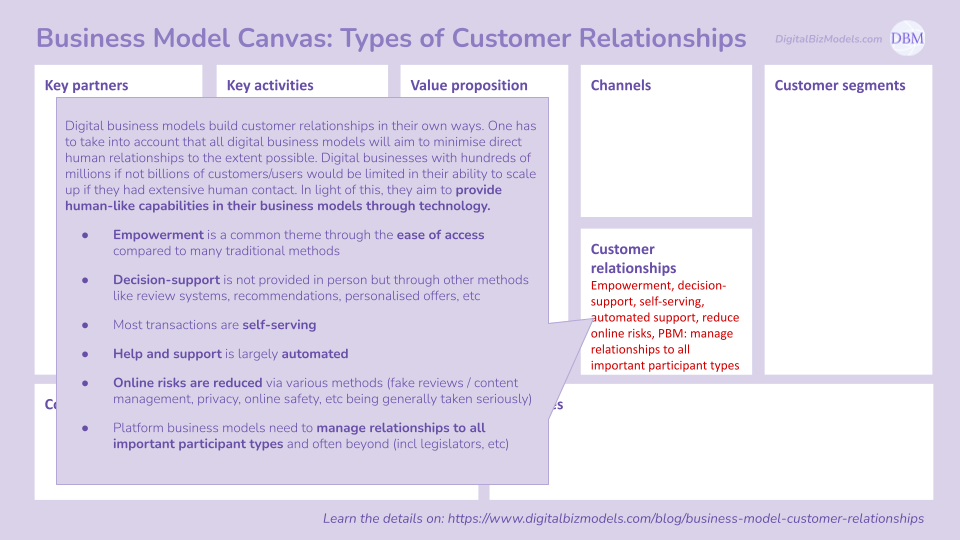

Customer Relationships

Netflix has an on-demand, self-serving relationship with their customers. No longer do people have to wait for linear programming to play the shows/movies that TV/cable channels do just to get interrupted by annoying ads every few minutes. Customers are empowered to watch anything, anytime without interruption. Add to this the ability to binge-watch entire seasons of TV shows. The times of cliffhangers followed by a week’s wait are gone. What’s more, the recommendation system suggests content that the user is likely to enjoy and may not have been aware of. All this leads to highly empowering customer relationships.

Ability to watch anything on demand and all episodes available at once gives a sense of self-control

The exclusion of ads reduces frustration and enhances loyalty

The recommendation system: provides personaisation

The whole theme, voice and style: entertaining, relaxed, light-touch, friendly

Self-service through App: basically all interactions are managed through the app and website, including help system

User support: via live chat, call or call through the app

Social media: Facebook and other for trailers and interactions

Learn more about the customer relationships of digital business models here.

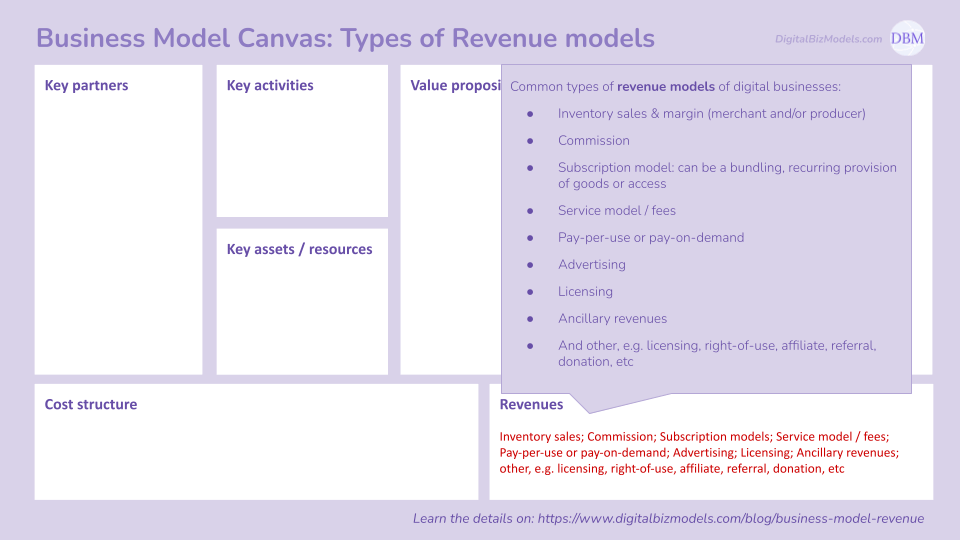

Revenue

The far majority of their revenues come from subscription fees at this stage. There are opportunities for other types of future revenues (incl tiers, premium content, licensing out their owned content, etc).

Netflix Revenue Sources:

Subscription fees:

International streaming (Europe/EMEA: 32% in 2022, LATAM: ~12% in 2022; APAC: ~11% in 2022)

US streaming (43% in 2022)

US DVD (insignificant)

3 different plans

In future:

Licensing revenues for Netflix-owned content

Learn more about revenue generation in digital business models here.

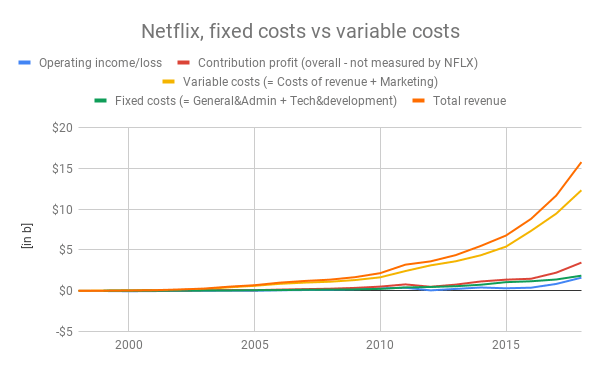

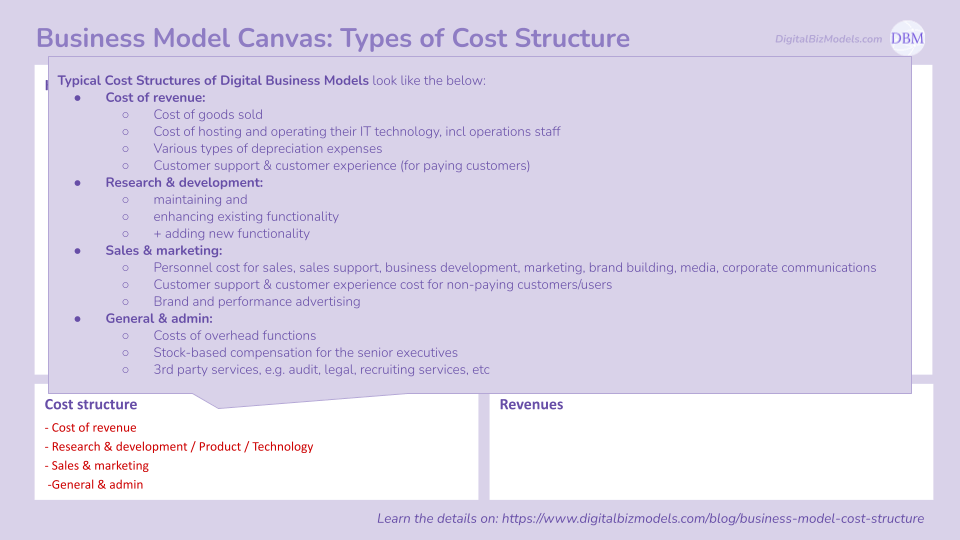

Cost Structure

The remarkable thing about Netflix's cost structure is how large their cost of revenue is in relation to all other costs. It consumes 58% of their revenues (!) and is about 3-times as high as all other cost combined in 2022.

Netflix Cost Structure:

Costs of revenue:

Content amortisation (biggest cost in the business)

Payment processing fees

Customer service

Streaming delivery costs (e.g. open connect costs, payroll)

Operations costs (incl cloud computing)

Marketing

Technology and development

General & admin

Learn more about the cost structures of digital business models here.